Blog

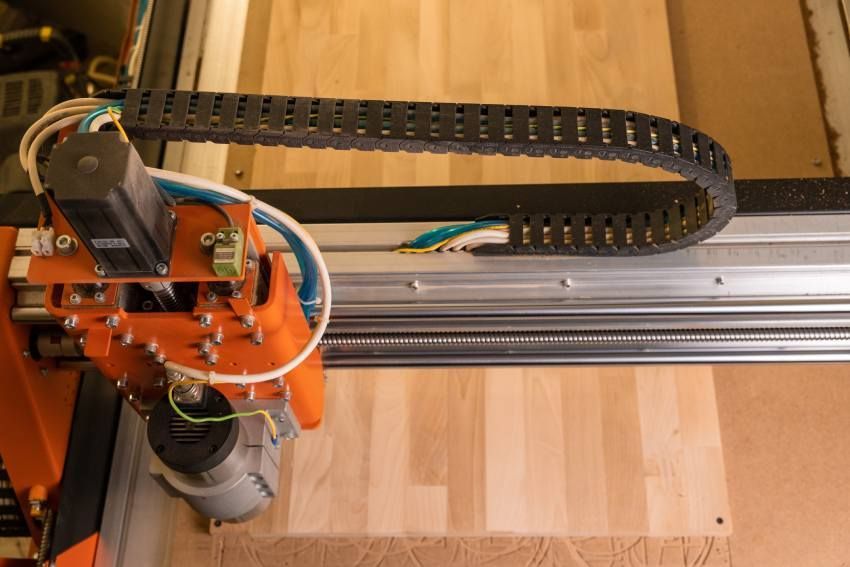

What the One Big Beautiful Bill Act Means for Manufacturers Our financing partner, Machinery Finance Resources (MFR), recently shared major news: the One Big Beautiful Bill Act (OBBBA) brings back powerful tax advantages for U.S. manufacturers investing in capital equipment. If you’ve been considering CNC routers, edgebanders, dust collection systems, or fabrication equipment , 2025 is shaping up to be the best year in over a decade to make your move. Key Tax Benefits for 2025 100% Bonus Depreciation Restored You can now deduct 100% of the purchase price for eligible new or used equipment placed in service after January 19, 2025. That means your entire investment could be written off in the same tax year — an immediate cash flow advantage. Section 179 Expensing Limit Doubled The Section 179 deduction jumps to $2.5 million, with phase-out starting at $4 million. Smaller and midsize shops can now deduct more of their capital investments, improving ROI and speeding up payback periods. Immediate R&D Expensing Prototyping, tooling, and process improvements are now fully deductible in the year incurred. For shops upgrading programming, workflows, or automation, this provides another layer of savings. Permanent Tax Relief for Pass-Through Entities If your shop operates as an S-Corp, partnership, or LLC, the Act permanently extends individual tax cuts, meaning lower tax rates on your business income — and more cash to reinvest. Why It Matters for Woodworkers and Fabricators For cabinetmakers, countertop fabricators, and millwork shops, automation and precision are key to scaling profitably. These tax incentives make those upgrades more affordable than ever. Example: A $750,000 CNC investment could yield approximately $165,000 in tax savings (based on a 22% tax rate) when combining Bonus Depreciation and Section 179. That’s money you can reinvest in materials, staff training, or additional equipment. Smart Timing and Strategy for 2025 1. Align Equipment Purchases with Tax Planning Coordinate installation dates with your accountant to ensure equipment is placed in service after January 19, 2025 to qualify for the full benefits. 2. Combine Section 179 and Bonus Depreciation Use both tools together — Section 179 first, then Bonus Depreciation — to maximize deductions and accelerate your ROI. 3. Explore Financing Through MFR Machinery Finance Resources offers custom equipment financing solutions that align with these tax incentives. Minimize your upfront capital while taking full advantage of the deductions. Ready to Act? Diversified Equipment & Supply partners with top manufacturers and financing experts to make your 2025 capital planning seamless. Next Steps: Contact DES to discuss eligible CNC equipment and installation timelines. Connect with Machinery Finance Resources (MFR) to structure flexible financing that supports your growth plans. Work with your CPA to lock in tax savings early. 👉 Read the Full Tax Incentive Breakdown from MFR Includes examples, R&D guidance, and a one-page savings calculator to estimate your potential deductions.